by Zella

Human's mobility has become more sophisticated over the centuries; we have to go far and wide to accomplish one thing or the other. Movements within short distance can be walked, but when it comes to long-distance, then a vehicle is needed. However, moving around in commercial transportation can be too costly, especially when it involves the whole family. Thus, it is necessary to own a car for easy and quick movement. Aside from a necessity, other people see cars as a luxury. Whatever the purpose of wanting a car, Auto Loan is one of the most convenient ways to get one.

Contents

Saving up to buy a brand new car is a long catch, while saving up, the price of the car may go up, and one will have to save extra. An Auto Loan is a type of loan designed for people who needs a car but can't afford it at the moment. Auto Loan focuses on purchasing cars. Though there are auto lenders that will release fund for borrowers to buy a car of their choice, some will buy the vehicle on behalf of the burrower and give it to the borrower. Then the borrower will make a monthly payment until the worth of the car is fully paid. The next section explains features of Auto Loan.

You must have been hearing and seeing Auto Loan offers in ads, but the ads are not self-explanatory enough. Below are some highlights and terminologies used in Auto Loan contexts:

There are two major types of Auto Loan, which are Secured Auto Loan and Unsecured Auto Loan. None of the two is better the other; each has a unique feature and is designed to suit the different financial situations.

1. Secured Auto Loan ; in this type of loan, you as a borrower must provide security. The security can be a fixed or movable asset, e.g., house, jewelry, land, etc. The asset provided by the borrower will be used as collateral in case the borrower defaults the loan. Usually, the assets provided must worth the car took on loan. The borrower must have official documents certifying the ownership of the provided assets. This type of loan is good for getting expensive cars on loan because lenders quickly agree to this type of loan when they see a worthy asset for security. Another benefit of secured loan is that it always comes with longer term, usually more than 10 years. However, loan defaulters will lose asset to lenders.

2. Unsecured loan ; in contrary to a secured loan, an unsecured loan does not require borrower using his/her asset as security. So, no worry about losing assets to lenders. However, an unsecured loan has many downsides; little principal and a shorter term are the major disadvantages. Heavy persecution for loan defaulters is the main reason why people run away from unsecured Auto Loans.

What do you need to get an Auto Loan?

You will need 3 types of documents to obtain a car loan:

This calculator is an independent car loan calculator; it has a clean interface and calculates very fast. To calculate accurate monthly payment, the calculator put in all factors such as vehicle's sale tax, trade-in value, etc. Other input values required to perform a quick calculation are loan term, purchase price, down payment, rebate amount, and so on. You will be able to see the breakdown of the payment and representation in graphical form. You might also see some advertisements on the web page. But they are car-related advertisements, so they might be beneficial in the long run.

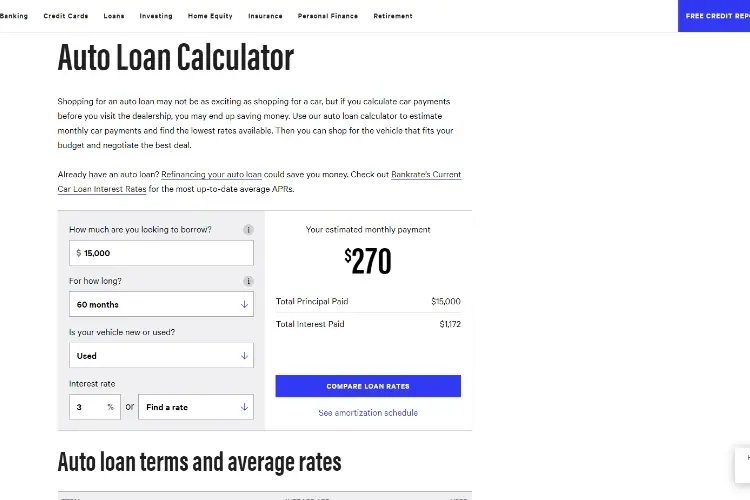

Bankrate is one of the most popular financial comparison services. One of the services provided by Bankrate is this efficient Auto Loan calculator. Bankrate Auto Loan calculator lets you calculate monthly payments with preset loan terms such as 36 months, 48 months, and 60 months. Other inputs required are principal, rate, and status of the car; either brand new or fairly used. Other characteristics of Bankrate loan calculator are recommendations of lenders, documentation on how to use the calculator efficiently, and other tips on how to get the best car loans. Bankrate does not display advertisements.

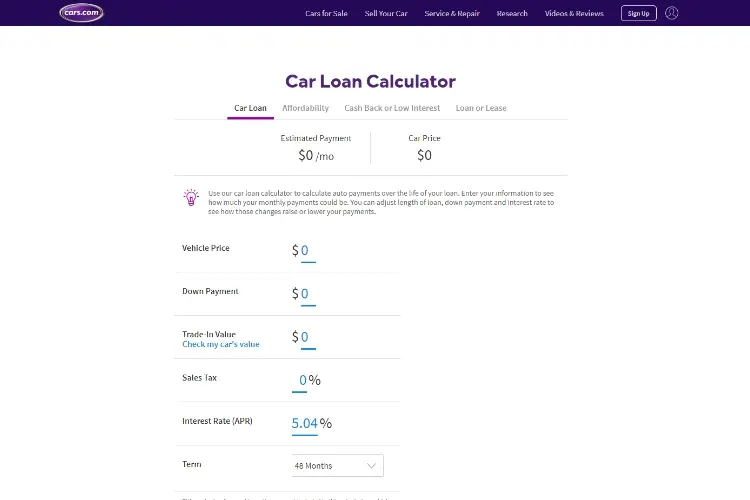

This Auto Loan calculator generates a comprehensive monthly payment. This calculator is a minimal calculator that accepts few variables and generates result quickly. Not only does the cars.com auto loan calculator calculate accurately, but it also provides suggestions of ideal cars to buy on loan using the estimated price and zip code. This calculator calculates based on four distinct systems which are;

· Car loan

· Affordability

· Cashback or lowest interest

· Loan or lease.

Cars.com displays few advertisements that may or may not relate to cars; you have to tolerate.

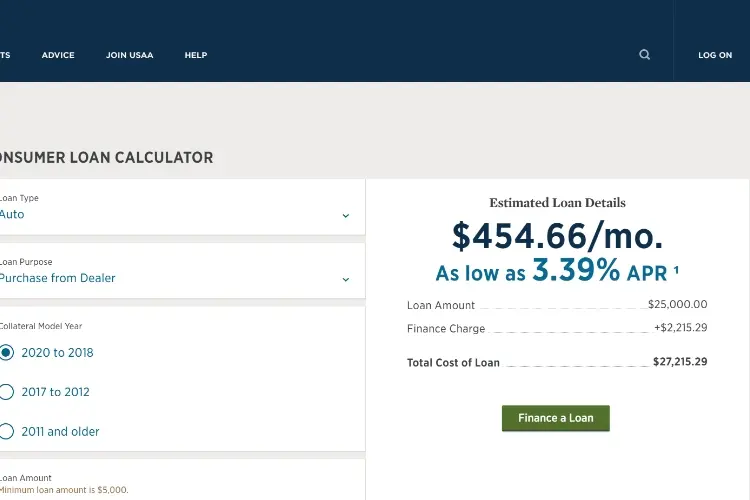

USAA Auto Loan calculator is exclusively available for the United States military members and their families. The calculator puts in factors such as loan amount, model and year of manufacture, interest, and purpose of acquiring the car. With all of these, you can get exact monthly payment before proceeding to take a new loan or refinance an existing loan. Not that this loan is only available for military personnel and their family (both active service and retired), and military verification will be required.

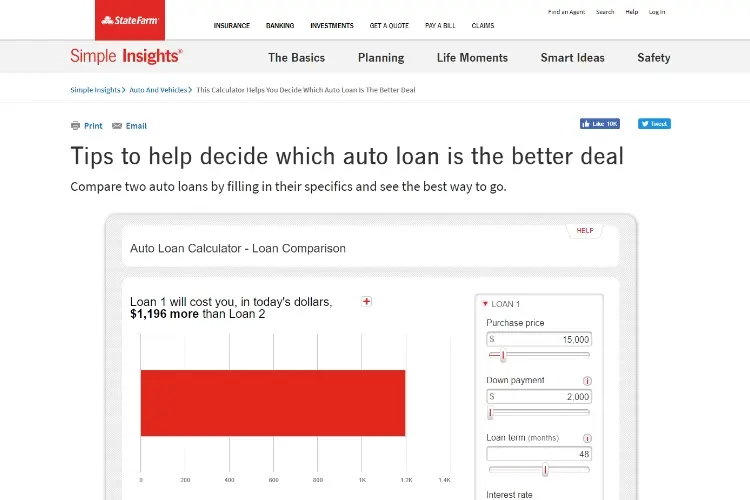

Statefarm calculator does not only allow you to calculate car loans, but you can compare loans in the range of the generated monthly rate. The calculator lets you decide which Auto Loan is convenient for you so that you can apply immediately. The inputs required are the price of the car, term of the loan, interest rate, and down payment. A graphical interface is also provided for easy understanding of the loan break down. While comparing car loans in the result range, Statefarm will display lenders nearest to you.

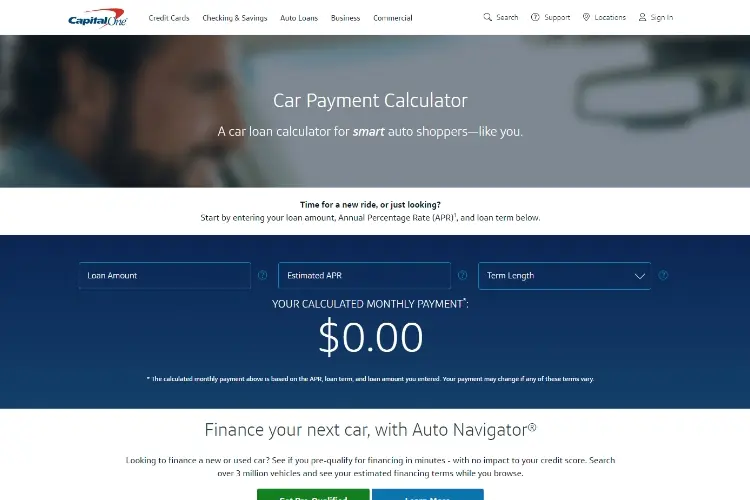

In addition to generating an accurate monthly payment, Capital One Auto Loan calculator allows you to "get pre-qualified" so that the loan will be granted as soon as possible. With the calculator, you can connect with loan institutes in minutes.

Note that these calculators are generic and are not 100% accurate. You can get the most accurate monthly payment from loan providers. And it would be better to use loan calculators from Auto Loan providers if they provide one. Nevertheless, it is better to be prepared before approaching an Auto Loan agent. The information contained in this article and various Auto Loan calculators will help you prepare for the loan. All the calculators are web-based, and you can access them from various devices. Good luck!

About Zella

Zella is a writer and filmmaker known for her work in the field of media arts. She hails from Tohatchi, New Mexico, and has achieved notable accomplishments throughout her career. Zella holds a bachelor's degree in Media Arts from the University of New Mexico and an MFA (Master of Fine Arts) in Creative Writing from the Institute of American Indian Arts.

|

|

|

|

Time for FREE Giveaways, and Free Gifts luck now

Reveal all secrets with adblock move. Hit a button below to show all

|

|

|

|