by Zella

In this era, having home is not just a necessity; the type and quality of the home assert class. Thus, mortgaging has become more prevalent in recent years. Though there are other ways of buying a home such as rent-to-own, paying with cash, getting owner finance, and so on. A mortgage is the most common method of owning a home, especially in developed countries like USA, UK, etc.

A mortgage is a special kind of loan that involves real estate property; the property may be land or building (non-movable properties), and the borrower must specify the purpose of the loan. Though the property is registered as borrower's property, the lender may seize it and sell it off to pay the loan if the borrower defaults the loan. Unlike other loans, a mortgage is 100% focused on the real estate industry; land, buildings, homes, etc. Most times, the lender asks to see and observe the property before releasing the loan.

Alternatively, people use a mortgage to raise funds for other purposes, but burrower must own land or building property. The lender put a lien on the asset while the borrower is paying off the loans. If the borrower fails to meet the conditions of the loan, then the lender can sell the asset to pay the mortgage.

Not only banks offer mortgage loans, other institutions that offer mortgage loans are;

Every mortgage has two main features, which are principal and interest features.

1. Principal; this is the actual amount a borrower borrow from the lender. For example, if a person gets a $500,000 mortgage loan, the mortgage principal is $500,000.

2. Interest; this is the money paid for using the loan, i.e., interest on money borrowed. Interest is also the profit of the lender. Mortgage interest varies from one lender to another, and it also depends on the size of the mortgage loan. Mortgage interest depends on other factors such as the size of down payment, term of loan, and so on.

Other features are;

3. Term; payment period. Term of loan highly influences mortgage interest. Generally, longer mortgage terms attract higher interest while a shorter term is with low interest.

4. Payment amount and frequency; this refers to the minimum and maximum amount to be paid per month. Frequency refers to the number of times it will be required to pay off the debt.

5. Prepayment/down payment; some mortgage loan may require a certain percentage of the loan before the loan is granted. Then the borrower will pay off the rest later. Sometimes, prepayment is seized to penalize borrower for loan defaulters.

There are numerous types of mortgage loans, but only 8 will be discussed here:

· Fixed/general mortgage loan; borrowers generally embrace this type of loan because of its consistency; the monthly rate is constant throughout the lifetime of the loan. This is the accepted standard of mortgage loan and is available in varieties of terms. The terms range from 10 to 40 years, sometimes 50 years. The most common fixed loan term is 15 and 30 years.

· Interest-only mortgage; this type of loan allows the borrower to pay only the interest within a specified period of the time. For example, if a borrower takes a 15 years mortgage loan, he/she may be required to pay only the interest for the first 5 years. Then he/she pays the principal for the remaining 10 years.

· Adjustable-rate mortgage; this type of mortgage is dynamic, the interest rate changes while the loan is active. There are many factors responsible for the changes. For example, the interest rate may change because of the economy, or the change in the value of asset provided by mortgager. The rate is dynamic, though, but there is an agreed period before the interest rate changes. E.g., the rate may change every 5 years. Also, the adjustable-rate mortgage is associated with compound interest.

· FHA loans; this type of loan involves the Federal Housing Administration. FHA provides flexible loans and also put in place insurance policies that make it convenient for mortgager to pay the mortgage. For example, FHA loans have the smallest down payment when compared with other types of loan. It is mostly granted for civil service workers because the interest can be directly deducted from their earnings.

· VA loans; this loan is exclusive to veterans of the United States Armed forces. After their service to the country, a way to pay ex-servicemen is to make it easy for them, or their spouse to own a home. VA loans are guaranteed by Veteran affairs and do not require any down payment.

· Combo loan; this type of loan allows you to combine two loans at a time, therefore avoiding 2 mortgage insurance payment. Combo loan always requires a maximum of 20% down payment, thus making it easy to obtain.

· Balloon; balloon mortgage loan is similar to an interest-only mortgage. Mortgager only has to pay the interest for a certain period, and then start paying the principal after.

· Jumbo loans; the jumbo loan is the father of all mortgage loan. For a loan to be classified as jumbo, it has to be very big; even federal governments won't guarantee or purchase this type of loan.

Benefits of mortgage

Mortgage loan may sound scary because of the forfeiture of properties to lenders, but it is the most convenient method of owning real property or raising funds for other purposes. Here are some advantages of mortgaging.

ü Buying capacity; fixed properties such as house and land has never lost worth; instead, it increases in value. This factor alone makes it harder for people who do not have these assets to get them. Raising a considerable sum of money to purchase these assets is almost impossible, and considering the fact that price will continue rising while saving up for the asset. Mortgaging is the best way to go; the agreed price of the asset remains fixed irrespective of the loan term.

ü Ease of payment; other types of loans may require you pay the whole sum at a go, but the mortgage payment is monthly installment, and the term is always long.

ü Better credit score; as a mortgage loan is repaid, credit score improves.

ü Tax benefits; one of the perks of mortgage loan is tax benefits; it reduces the amount of tax paid to the government. This is the reason why you see people going for a mortgage even if they have the cash to purchase the property. Or people going for the second mortgage loan after paying off the first one.

Mortgage calculations are sometimes complicated, and incorrect calculations are misleading. Most of these mortgage money lenders who have online portals sometimes provide custom calculators on the web or mobile app platform. However, there are other conventional mortgage calculators on the web, and in this article, we are going to be reviewing 10 best free mortgage calculators. They are web-based and are available 24/7. You can use them on smartphones, tablet, PC, or any device that is capable of accessing the internet and has a web browser installed on it.

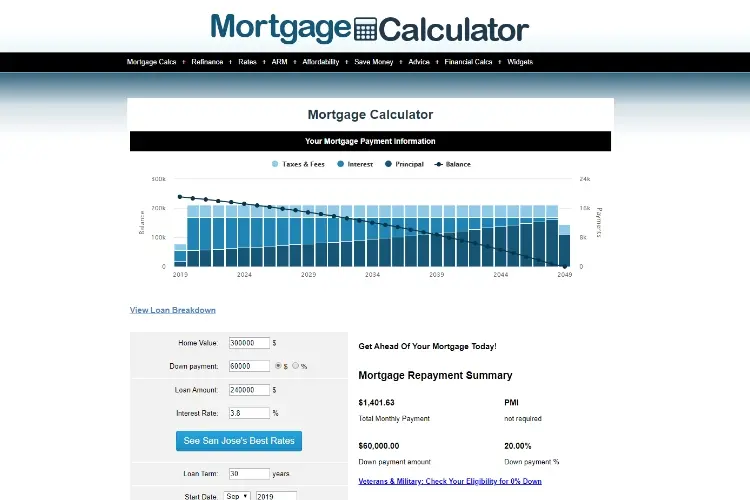

The title given to this online mortgage calculator helps its SEO, and that is why it became so popular. Imagine typing 'Mortgage Calculator' on search engines; this particular calculator comes first in search results, whether you are trying to search for conventional mortgage calculator or this specific calculator. Mortgage calculator is not only popular because of its name, its efficiency also contribute to the popularity. It is capable of calculating varieties of mortgage loans, and the user interface makes it very easy to use. With Mortgage Calculator you can view loan breakdown, get exact of monthly payment and see the best rates suggestion in your geographical area.

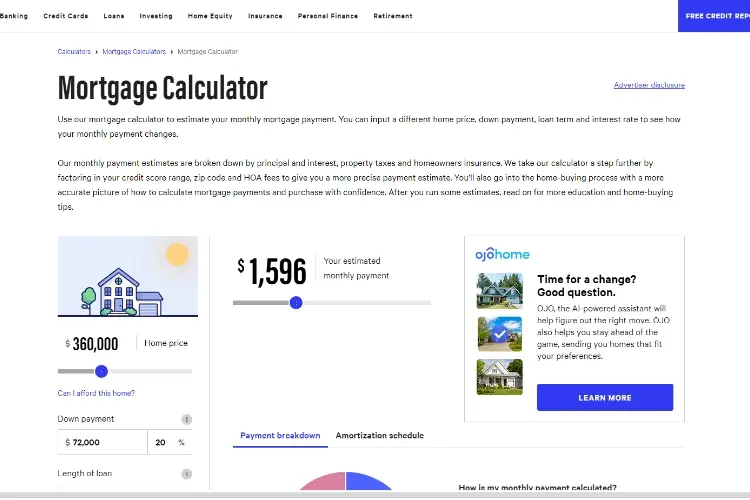

Among other comparison and estimation services provided by bankrate.com is the mortgage calculator, this calculator is one of the best mortgage calculators you will find on the internet. The calculator accepts diverse inputs such as home price, loan term, down payment, etc. And then calculate an accurate estimation of what the monthly rate will be. Bankrate mortgage calculator also breaks down the monthly estimation into principal, interest, property tax, and homeowners insurance. More features of Bankrate mortgage calculator are

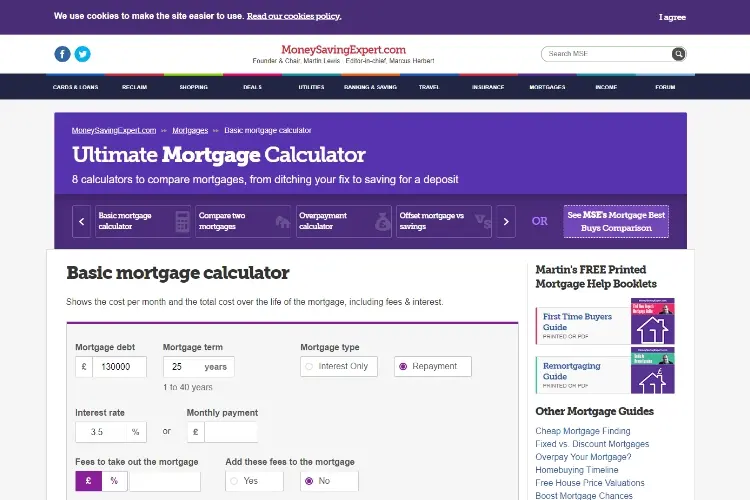

Moneysavingexpert.com is another website that offers comparison services; one of its numerous services is the mortgage loan calculator. Though, Ultimate mortgage calculator provides computer-generated estimation, it is one of the most reliable mortgage loan calculators on the internet. This calculator is capable of calculating the specific payment per month, and the overall payment of the loan. Features peculiar to Ultimate mortgage calculator are:

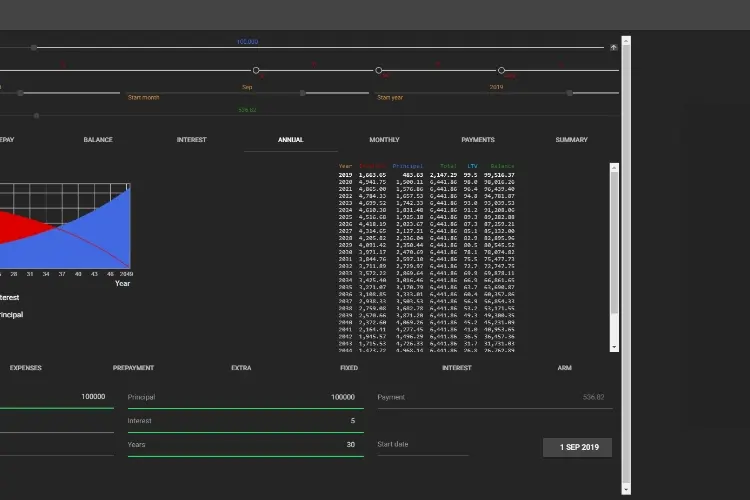

Accuracy and visualization are what makes Karl's Mortgage Calculator stand out. While other mortgage calculators will demand you type values inside text boxes, Karl's Mortgage Calculator only requires using the slide bar. This feature contributes to overall usability and makes the calculator usable on devices with smaller screens. Karl's Mortgage Calculator calculates live without reloading the page; the estimation is done as soon as you are done adjusting the sliders to the desired value. Features peculiar to Karl's Mortgage Calculator are:

CNN has a dedicated mortgage loan calculator under its real estate section. CNN Mortgage Calculator provides a real-time monthly estimation from different zip codes. The estimation makes use of factors such as tax, insurance, etc. A unique feature of CNN Mortgage Calculator is the ability to find properties that match your calculated mortgage estimation, so that you may apply for the mortgage immediately.

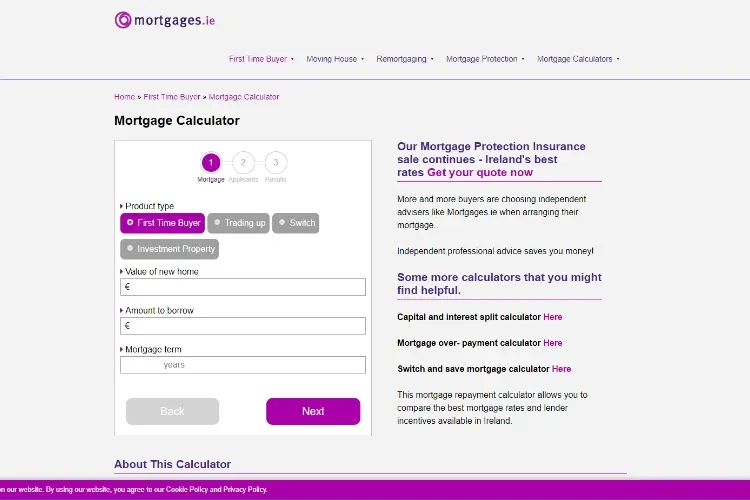

Mortgages.ie is a minimalistic mortgage loan calculator. It is minimalistic both in appearance and functionality. Mortgages.ie takes only a few inputs and generates an accurate estimation within seconds. With Mortgages.ie, you can choose from the 4 types of mortgages available. Mortgages.ie calculates in Euros but you can convert back to your desired currency once you are done calculating. With Mortgages.ie, you can also perform calculations for other types of mortgaging services such as remortgaging, mortgaging protection, and so on.

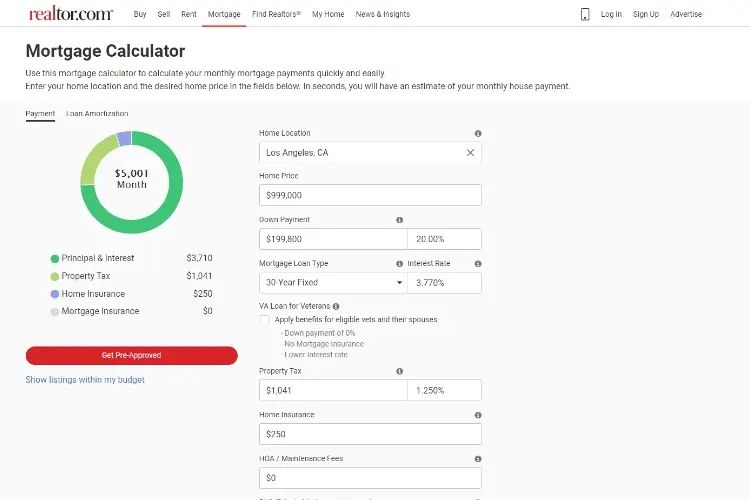

One of realtor.com several tools is the Realtor Mortgage Calculator, it calculates accurate monthly rates based on location. Realtor Mortgage Calculator only needs an accurate geographical location and price of the loan. Realtor Mortgage Calculator takes several precise inputs and calculates the monthly payment in seconds. The generated payment can also be represented with statistical graphs for easy understanding.

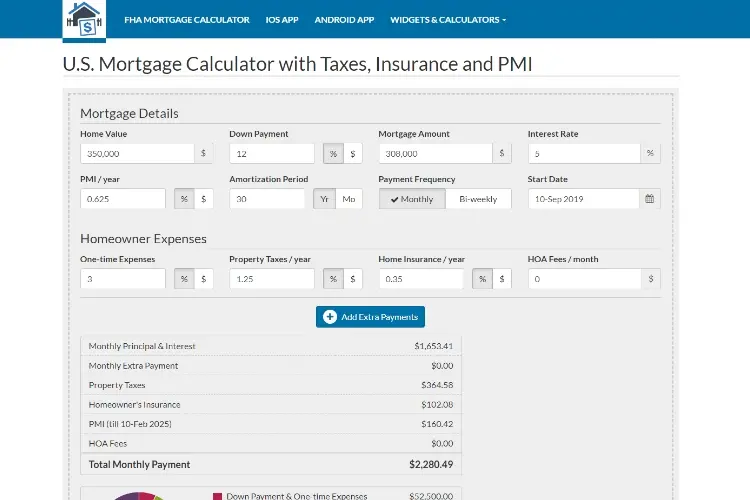

This calculator is exclusive to US mortgagers because it put into factor the US tax, insurance, and PMI. US Mortgage Calculator may seem a little bit complicated, but its results are very accurate. The calculator is available on Android and iOS platform. If you are a website owner, you can integrate US Mortgage Calculator for your users to calculate mortgage loans directly on your website.

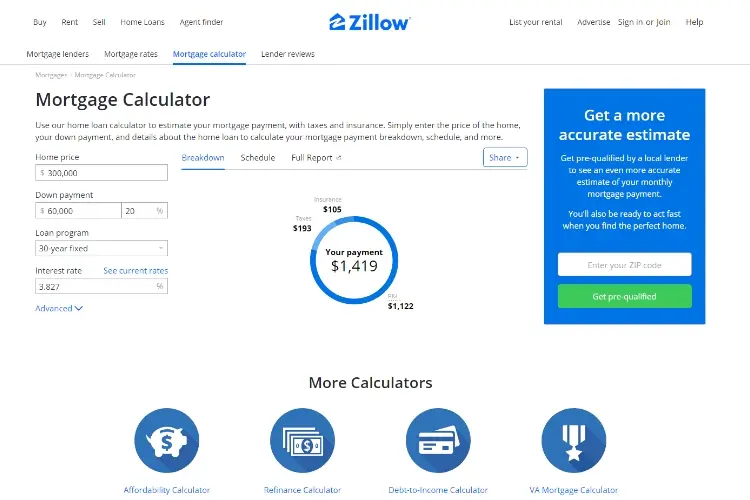

Zillow is like a search engine to find homes. It is only better if it helps in calculating mortgage loans. Zillow mortgage calculator is simple, and you can view the mortgage report on demand. You can also view the report in statistical form for easy understanding.

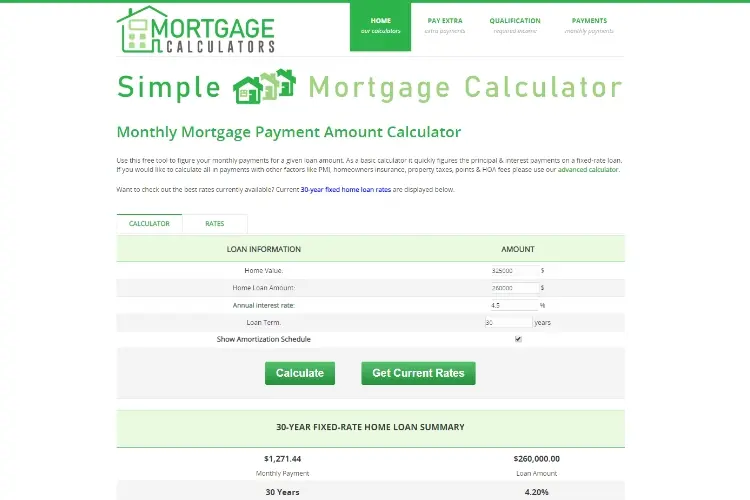

With this calculator, you can quickly figure out your monthly payment for a mortgage loan. Mortgagecalculators.info is a basic calculator that quickly calculates principal and interest on a fixed-rate loan. However, if you are going to calculate more complicated types of loans, it is better to use another mortgage loan calculator from the list.

Mortgaging is the most convenient method of purchasing a fixed property, and with these online calculators, it will be more convenient calculating the mortgaging monthly payment. Have it in mind that the calculator provided by a mortgage lender is the most accurate calculator for mortgage loan offered by such lender.

About Zella

Zella is a writer and filmmaker known for her work in the field of media arts. She hails from Tohatchi, New Mexico, and has achieved notable accomplishments throughout her career. Zella holds a bachelor's degree in Media Arts from the University of New Mexico and an MFA (Master of Fine Arts) in Creative Writing from the Institute of American Indian Arts.

|

|

|

|

Best Topics of the Day

Time for FREE Giveaways, and Free Gifts luck now

Reveal all secrets with adblock move. Hit a button below to show all

|

|

|

|